Observatory

Exits in the Spanish startup ecosystem

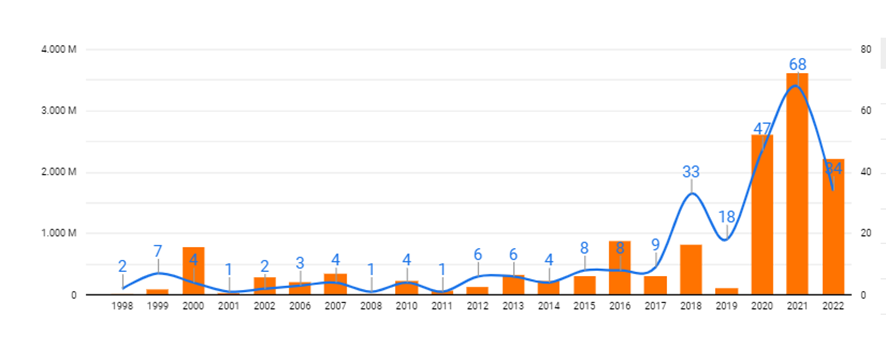

Traditionally there has been little exits or divestment activity in the Spanish startup ecosystem, but this trend has changed, demonstrating the maturing of the ecosystem.

Exits in the Spanish startup ecosystem have been a rare event, historically. This trend was reversed in 2020, when these deals have grown exponentially, partly due to greater international exposure, and partly due to significantly higher quality Spanish companies.

First off, note that price figures are known for 58% of deals, and 67% in 2022. So, these data pertain public deals only.

By aggregating the data of published deals, collected by the Startup Observatory, we can present the main features of exits or divestments in the Spanish startup ecosystem.

1.- There have been a grand total of 270 exits in the Spanish ecosystem, amounting to €13 billion. Year to date, there have been 34 deals worth more than €2 billion

2.- Startups that have had an exit in 2022 had previously captured, on average, €32.5 million—a token of the growth of startups and investment in Spain.

3.- If we zoom into exits per industry, software is the most active, while Mobility & Logistics tops the value ranking.

Business & Productivity is the sector where there have been more divestments in 2022. The dominant sector, measured in capital generated, is Mobility & Logistics, due to the large operations with Reby, Glovo and Clicars.

4.- Regarding the location of divested startups, Madrid leads the ranking (108 deals) vs Barcelona (88). This trend reverses in 2022, when Barcelona-based startups lead in exits, with 44% of deals.

5.- Regarding the buyers, we should highlight Industrial players as the most active, accounting for 52% of deals.

In most cases, the buyers in 2022 (this applies to 70% of deals) were another startup or a tech company.

6.- Types of Exits. Most deals are inorganic growth, where a company buys the startup (M&A). Despite a slight increase, Initial Public Offerings are still a minority. Partial exits (secondary market) are more common, but M&A continues to dominate this market.

Find out all the details of these successful operations in the Startup Observatory.